An HSBC personal loan is a practical option if you need flexible financing for home improvements, travel, or debt consolidation.

It offers a straightforward borrowing option with fixed monthly payments and no hidden fees.

This guide explains how to apply, what documents you need, and what to expect throughout the process.

Overview of HSBC Personal Loan

The HSBC Personal Loan offers fixed monthly payments with no hidden fees.

It's ideal for covering personal expenses like home upgrades or debt consolidation.

Key Features

The loan comes with clear terms and convenient benefits. Here are the main features you should know:

- Fixed interest rates for predictable monthly payments

- Borrow from £1,000 to £25,000 (or more, based on eligibility)

- Repayment terms from 1 to 5 years

- No arrangement or early repayment fees

- Quick application with a fast approval decision

- Funds are typically available within 1–2 working days after approval

Target Borrowers

This loan is designed for individuals who need straightforward financing for personal use. Here’s who it’s best suited for:

- UK residents aged 18 or over

- Salaried or self-employed individuals with stable income

- Existing HSBC account holders or new customers

- People planning home renovations, travel, medical bills, or debt consolidation

- Borrowers with a good to excellent credit history

Eligibility Requirements

Before applying, make sure you meet the basic criteria set by HSBC. These requirements help determine if you qualify for a personal loan:

- You must be at least 18 years old.

- You need to be a UK resident.

- Have a regular income from employment or self-employment.

- Possess a good credit history.

- Be able to provide proof of identity and address.

- HSBC current account may be required for certain loan types.

Required Documents

To ensure a smooth application process, gather the necessary documents in advance. Here's what you'll typically need:

- Valid government-issued ID (passport or driver’s license)

- Proof of income (recent payslips or tax returns)

- Employment details (employer name, position, duration)

- Bank statements (to verify financial stability)

- Proof of address (utility bill or council tax statement)

- Loan purpose or reason for borrowing (general description)

Application Process

Applying for an HSBC Personal Loan is quick and can be done online, by phone, or at a branch. Follow these steps to get started:

- Visit HSBC’s official website or use the mobile banking app.

- Select “Personal Loan” under the borrowing options.

- Use the loan calculator to estimate monthly payments.

- Fill out the application form with your personal, financial, and employment details.

- Upload or provide the required documents.

- Apply for review.

- Receive a decision—often within minutes if applying online.

If approved, review and accept the loan offer.

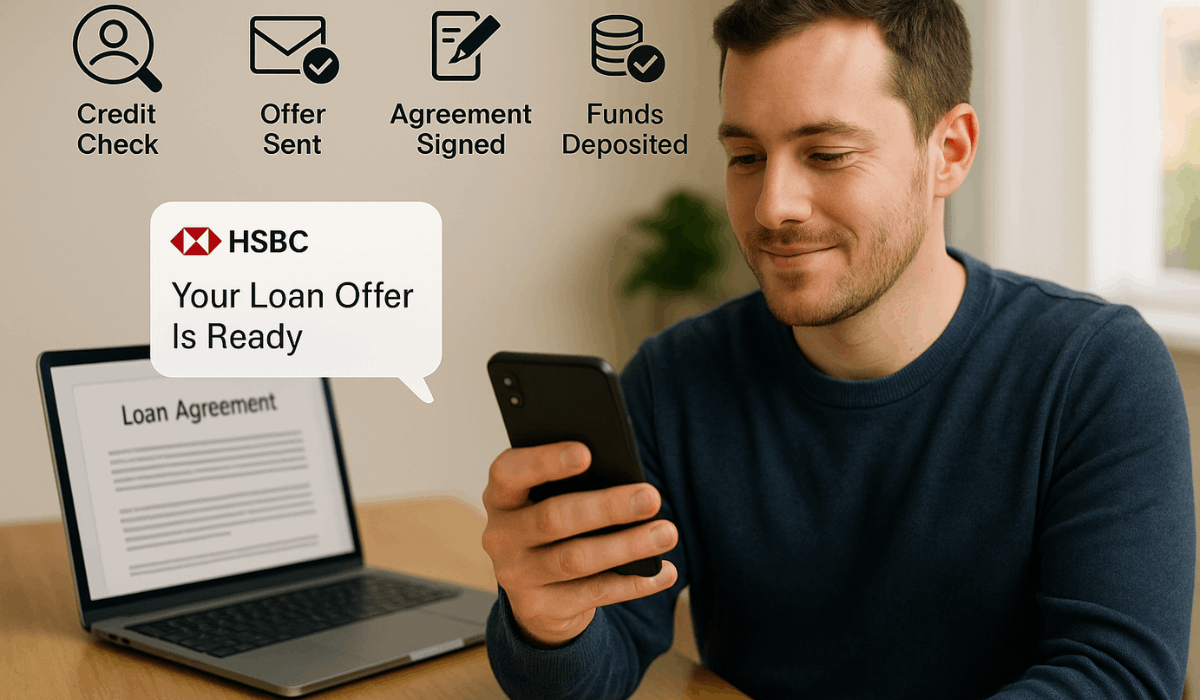

Post-Application Process

After submitting your application, HSBC will review your information and guide you through the following steps. Here's what typically happens:

- HSBC conducts a credit and affordability assessment.

- If approved, you'll receive a formal loan offer with terms.

- Review the offer carefully and accept it online or in-branch.

- Sign the loan agreement digitally or physically, as required.

- Funds are usually disbursed to your account within 1–2 working days.

- Begin repayments as scheduled based on the agreed terms.

How to Track Your Loan Application Status

Tracking the progress of your application after submitting it is essential.

Monitoring your application ensures you're ready for the next steps. Here's how to easily check your loan status:

- Check Through Online Banking: Log in to your HSBC online banking account to view updates on your loan application status.

- Use the HSBC Mobile App: Open the app, navigate to the loan section, and check the status of your application.

- Call HSBC Customer Service: For a status update on your application, contact HSBC’s customer service team at 03457 404 404.

- Email Confirmation: HSBC will email updates once your application is reviewed and processed. Be sure to check your inbox regularly.

- Visit Your Local Branch: If you prefer in-person support to check your application status, you can visit an HSBC branch for assistance.

Interest Rates and Fees

Before applying for an HSBC Personal Loan, it's essential to understand the associated interest rates and fees.

These can vary depending on your location and the specific terms of your loan.

- Representative APR: 6.4% for loans between £7,500 and £20,000.

- Loan Amounts: £1,000 to £25,000.

- Repayment Terms: 1 to 5 years for loans up to £15,000; up to 8 years for loans over £15,000.

- Fees: No arrangement or early repayment fees.

- Overpayments: Allowed without penalty, which can reduce the total interest paid.

Tips for Approval

Several factors affect approval when applying for this loan. Follow these tips to improve your chances of success:

- Maintain a Good Credit Score: A higher credit score improves your chances of approval and may lower your interest rate.

- Ensure a Stable Income: Show consistent income to demonstrate your ability to repay the loan.

- Keep Debt Levels Manageable: Avoid excessive debt to maintain a good debt-to-income ratio.

- Provide Complete Information: Fill out your application accurately to prevent delays or rejection.

- Meet Eligibility Requirements: Ensure you meet HSBC’s age, residency, and employment criteria.

- Consider a Co-Applicant: Adding a co-applicant can strengthen your application.

- Review Your Financial Situation: Understand your finances before applying to show responsibility.

- Avoid Recent Credit Inquiries: Multiple inquiries can hurt your chances, so minimize them before applying.

Managing Your Loan Responsibly

After your HSBC Personal Loan is approved, managing it responsibly is crucial.

Proper management helps you meet repayment obligations, avoid penalties, and maintain a good credit score. Here are key strategies:

- Make Timely Payments: Always make payments on time to avoid late fees and negative impacts on your credit score.

- Set Up Auto-Pay: Consider setting up automatic payments to ensure you never miss a due date.

- Stay Within Your Budget: Keep your monthly loan repayment within your budget to avoid financial strain.

- Monitor Your Loan Balance: Regularly check your loan balance to keep track of your debt and progress.

- Communicate with Your Lender: If you’re having trouble making payments, contact HSBC early to discuss options like restructuring or deferment.

- Avoid New Debt: To keep your finances stable, focus on paying off your loan before taking on additional credit.

- Pay More Than the Minimum: If possible, make extra payments to reduce your balance faster and save on interest.

HSBC Contact Information

If you need assistance with your HSBC Personal Loan or have any questions, contacting HSBC’s customer service is quick and easy.

Below are the various ways you can contact HSBC in the UK:

Phone:

- Personal Banking: 03457 404 404

- For Loan and Credit Card inquiries: 03457 404 404

- 24/7 support available

Online:

- HSBC UK Website

- Live Chat is available through the website for immediate support.

Email:

- General Inquiries: Use the "Contact Us" section on the HSBC website to send a secure message.

Branch Locator:

Find the nearest branch using HSBC’s branch locator tool on their website.

Social Media:

Post:

- HSBC UK, 8 Canada Square, London, E14 5HQ, United Kingdom

The Bottomline

In conclusion, applying for an HSBC Personal Loan can be straightforward if you understand the steps and requirements.

By managing your loan responsibly and staying in touch with HSBC’s support team, you can ensure a smooth borrowing experience.

Visit the HSBC website today to learn more and start your application.

Disclaimer

The information provided in this article is for informational purposes only and should not be considered financial advice.

Loan approval is subject to HSBC’s terms and conditions, and eligibility requirements may vary.